The Best Guide To Frost Pllc

The Best Guide To Frost Pllc

Blog Article

The 45-Second Trick For Frost Pllc

Table of ContentsFrost Pllc Fundamentals ExplainedSome Known Incorrect Statements About Frost Pllc An Unbiased View of Frost Pllc6 Easy Facts About Frost Pllc ShownThe Single Strategy To Use For Frost Pllc

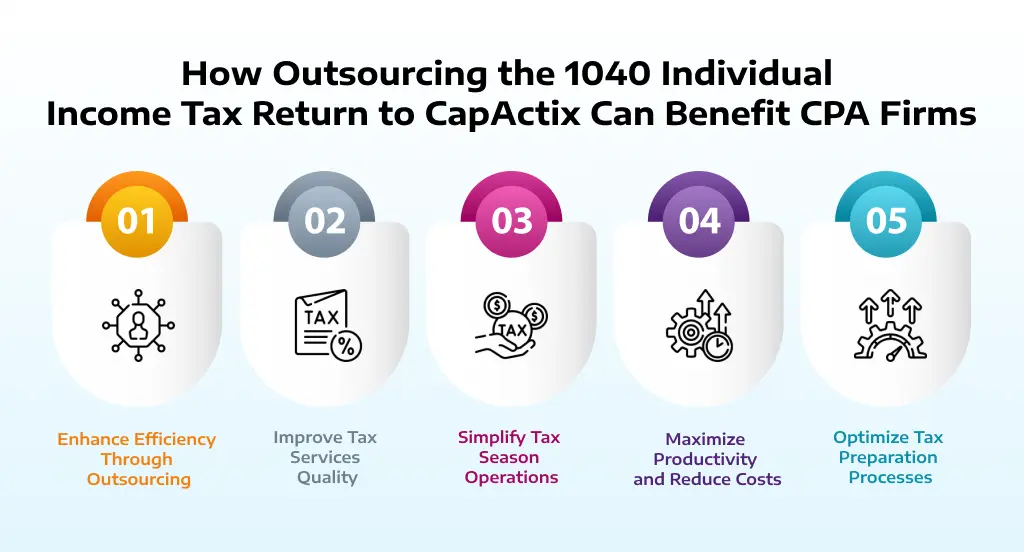

Certified public accountants are among one of the most trusted occupations, and forever reason. Not just do CPAs bring an unequaled degree of understanding, experience and education to the procedure of tax obligation preparation and handling your money, they are particularly educated to be independent and unbiased in their job. A certified public accountant will certainly aid you protect your rate of interests, listen to and resolve your problems and, just as important, give you satisfaction.In these defining moments, a certified public accountant can supply even more than a general accounting professional. They're your trusted consultant, guaranteeing your company stays monetarily healthy and balanced and legitimately protected. Working with a neighborhood CPA firm can positively affect your company's monetary health and wellness and success. Here are 5 vital advantages. A local CPA company can aid decrease your company's tax obligation concern while making sure compliance with all applicable tax obligation laws.

This growth mirrors our commitment to making a favorable effect in the lives of our clients. When you function with CMP, you end up being part of our family.

Everything about Frost Pllc

Jenifer Ogzewalla I have actually functioned with CMP for several years now, and I've actually appreciated their proficiency and effectiveness. When auditing, they function around my schedule, and do all they can to preserve connection of employees on our audit.

Right here are some essential inquiries to direct your choice: Inspect if the CPA holds an active license. This guarantees that they have passed the necessary examinations and satisfy high honest and specialist standards, and it reveals that they have the credentials to manage your economic matters responsibly. Validate if the CPA offers solutions that line up with your service needs.

Tiny services have distinct economic requirements, and a certified public accountant with appropriate experience can offer even more tailored recommendations. Ask about their experience in your market or with businesses of your dimension to ensure they understand your details difficulties. Understand how they bill for their solutions. Whether it's hourly, flat-rate, or project-based, recognizing this upfront will certainly prevent surprises and verify that their services fit within your spending plan.

Hiring a regional Certified public accountant company is even more than just outsourcing financial tasksit's a smart investment in your organization's future. CPAs are licensed, accounting professionals. Certified public accountants might work for themselves or as component of a company, depending on the setting.

The Only Guide for Frost Pllc

Handling this responsibility can be an overwhelming job, and doing something incorrect can cost you both economically and reputationally (Frost PLLC). Full-service CPA firms are acquainted with declaring requirements to guarantee your company adhere to government and state legislations, in addition to those of financial institutions, capitalists, and others. You might require to report extra revenue, which may require you to submit an income tax return for go to the website the very first time

team you can rely on. Contact us to find out more regarding our solutions. Do you understand the accounting cycle and the steps entailed in making certain appropriate financial oversight of your business's economic wellness? What is your business 's lawful framework? Sole proprietorships, C-corps, S corporations and collaborations are exhausted in a different way. The more facility your revenue sources, places(interstate or global versus neighborhood )and sector, the much more you'll need a CPA. CPAs have a lot more education and undertake an extensive accreditation process, so they cost greater than a tax preparer or accountant. Generally, small companies pay between$1,000 and $1,500 to employ a CPA. When margins are limited, this expense might beout of reach. The months prior to tax obligation day, April 15, are the busiest time of year for CPAs, complied with by the months before the end of the year. You might need to wait to get your inquiries responded to, and your tax obligation return might take longer to finish. There is a restricted variety of CPAs to walk around, so you might have a difficult time locating one especially if you have actually waited until the last min.

Certified public accountants are the" big guns "of the bookkeeping market and usually do not handle daily bookkeeping jobs. Frequently, these various other kinds of accountants have specialties throughout areas where having a CPA license isn't called for, such as administration accounting, not-for-profit bookkeeping, cost bookkeeping, federal government audit, or audit. As a result, utilizing a bookkeeping solutions company is typically a far much better value than employing a CERTIFIED PUBLIC ACCOUNTANT

firm to support your sustain important source financial recurring monetaryAdministration

CPAs additionally have know-how in creating and developing business policies and procedures and analysis of the functional needs of staffing designs. A well-connected CPA can take advantage of their network to assist the organization in different critical and seeking advice from functions, properly connecting the organization to the ideal candidate to satisfy their needs. Next time you're looking to load a board seat, think about reaching out to a Certified public accountant that can bring worth to your Clicking Here organization in all the ways provided above.

Report this page